A carer in need turned to Tower Street Finance for help

Having given up his career in the city to become the full-time carer for his Dad and then his Mum, Mark Porter was reliant on their pensions to cover the cost of looking after his parents and paying household bills. But, when Mark’s Mum sadly passed away in September 2020, the 52-year-old found himself in what he calls a financial ‘black hole’.

“Not only did I have to cope with losing my Mum, someone who I was very close to and who for the last five years I cared for since my Dad passed away, but I also had to figure out a way to pay the bills.

“I’ve never claimed anything from the Government while caring for my parents. We managed to get by on their pensions.

“I was the sole executor in my Mum’s will, but inheritance takes time. I needed some financial support to tide me over.”

Searching for help online Mark found Tower Street Finance’s Inheritance Advance.

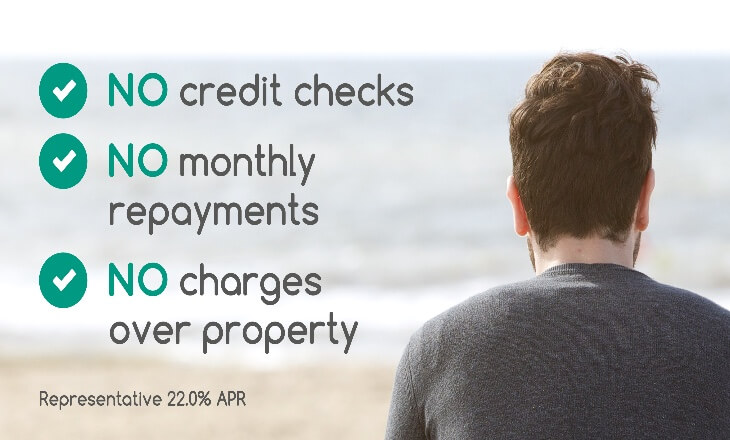

Inheritance Advance is a unique product that gives beneficiaries some of their inheritance early. There are no credit checks, no monthly repayments or charges over property and beneficiaries access up to 60 per cent of the value of their inheritance.

Mark says: “I did a quick search on Google and Tower Street Finance was the first name to come up. Inheritance Advance looked like a good product, different to others I had seen which called themselves probate loans, and exactly what I needed.

“I spoke to Tower Street Finance and they guided me through the process. They were very nice. In just a few weeks I had an advance of £15,000 on my inheritance.”

The home Mark shared with his Mum in London is now on the market and he hopes the sale will allow him to move to closer to family in Devon.

“Selling a property in lockdown comes with a few challenges, so I asked Tower Street Finance for a second Inheritance Advance of £15,000 to make sure I had enough in the bank to pay the bills and clear some debts. It’s made the whole process a lot less stressful.”

Once the sale of his two-bedroom flat goes through, Mark says he’s looking forward to treating himself to a holiday – something he admits he’s not had for at least 13 years.