Probate Explained

What is Probate and How Does it Work?

Probate is the legal and financial process of dealing with the property, money and possessions of a person who has died.

The probate procedure can be long and complicated. However, Tower Street Finance offers a range of dedicated products to help you access your inheritance.

The Probate Process Explained

- Step 1: Applying for a Grant of Probate

- The Executor of a Will (or Personal Representative when there is no Will) applies to the Courts for a Grant of Probate. This gives them legal control over the deceased person’s assets so that they can start the process of disposing of them, and therefore settle any liabilities of the Estate, before distributing the residual proceeds to the Beneficiaries.

- Step 2: Paying Inheritance Tax

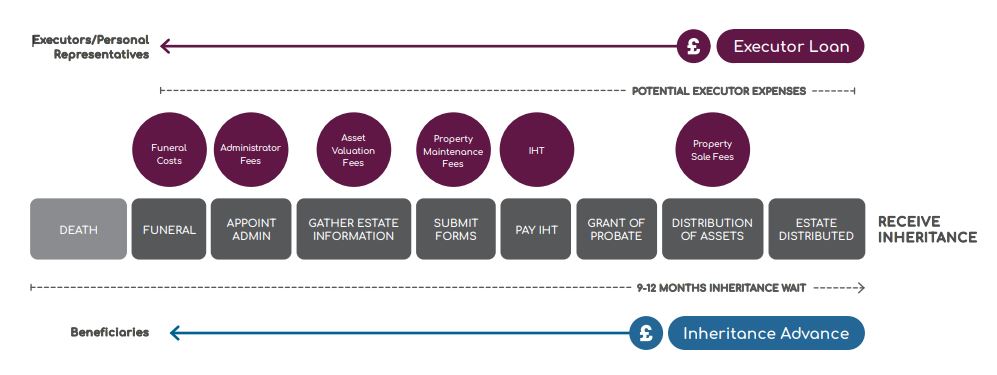

- However, in order to get the Grant of Probate, any Inheritance Tax (IHT) has to be paid to HMRC before it can be issued by the Courts. This means that the Executor/Personal Representative has to find the money to pay the IHT before they have access to the assets held in the Estate.

How Long Does Probate Take?

The final phase of the probate process involves disposing of the assets and the distribution of the estate proceeds to the Beneficiaries of the Will. Given how complicated the process is, it is usually 9-12 months before any of the Beneficiaries can make a claim on the Estate after probate and receive any money from the Estate.

Need Help with Probate and Inheritance Tax?

Probate is the process of administering a deceased person’s estate. It usually takes several months from the appointment of the Executor of the Will to receiving the Grant of Probate, and even longer to the final distribution of the assets to the beneficiaries.

Tower Street Finance recognises that the Probate and Inheritance Tax processes, and the delay before Beneficiaries receive any money, can have a significant impact on the Executor/Personal Representative/Beneficiaries.

We have therefore designed two unique products to help you with the different steps of the probate process:

- Executor Loan, for paying IHT to HMRC so the Grant of Probate is not held up

- Inheritance Advance, to allow Beneficiaries to access a proportion of their inheritance earlier

Do you want to learn more about Inheritance Advance, IHT Loan and Tower Street Finance?Visit our FAQs to find out more, or give us a call on 0343 504 7100 to find out how we can help you access your inheritance sooner.

Why Choose Tower Street Finance Probate Products

You may have heard of a Probate Loan (sometimes called Probate Finance, Inheritance Loan, Probate Funding or Probate Bridging Loan) but they are generally a re-badged standard Bridging Loan.

These Probate Finance products normally require you to wait until probate is granted before you can take your Inheritance Loan out.

Tower Street Finance’s Inheritance Advance product has taken the best features from other Probate Finance products on the market to design something available to a wider audience of people. More importantly, you don’t need to wait for probate to take one out.

The table below shows how our Inheritance Advance product compares with other products:

| Product Feature | Bridging Loan | Personal Loan | Inheritance Advance |

|---|---|---|---|

| No personal credit check |  |

|

|

| Available to people with adverse credit (e.g. CCJs) |  |

|

|

| No charge over property |  |

|

|

| No personal liability |  |

|

|

| No inheritance shortfall risk |  |

|

|

| No monthly repayments |  |

|

|