Inheritance Tax (IHT) Explained

What is Inheritance Tax?

Inheritance Tax, or IHT as it is also known, is the tax that is charged on the value of a deceased person’s Estate. The tax paid is charged at a rate of 40% when the value of the Estate is above the Inheritance Tax threshold. IHT can be complicated, but, with our guide, you’ll learn how it works, how Inheritance Tax is calculated, who must pay it, and what to do if you can’t afford it.

How much is Inheritance Tax?

Who pays Inheritance Tax?

When do you pay Inheritance Tax?

What do you pay Inheritance Tax on?

Inheritance Tax gifts & exemptions

How to pay Inheritance Tax?

What happens if you can’t afford to pay Inheritance Tax?

How to get a loan to pay Inheritance Tax?

How much is Inheritance Tax?

The single person’s Inheritance Tax threshold in the UK is £325,000. That means tax must be paid when the value of an Estate is above this amount. The rate is calculated at 40% of anything over the £325,000. As an example: If an estate is worth £500,000, then Inheritance Tax would be payable by an individual on the £175,000 over the Inheritance Tax threshold of £325,000. At a rate of 40%, this would equal £70,000. In the 2019/2020 tax year the average Inheritance Tax bill was over £220,000, an increase on previous years. These rates are representative of a single person’s Inheritance Tax allowance and there are different rules for married couples and those in civil partnerships.

Who pays Inheritance Tax?

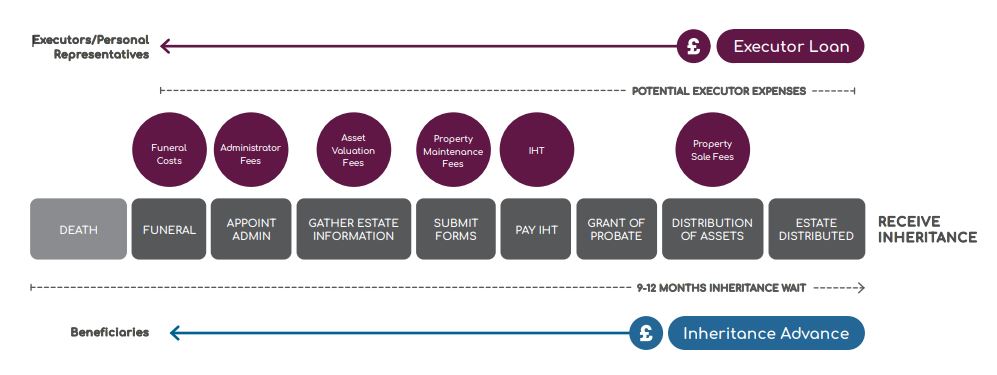

If there is a Will, the Executor is usually liable to settle the Inheritance Tax bill. However, if a Will hasn’t been left then the responsibility for the payment of Inheritance Tax will fall to the Administrator (Personal Representative) of the Estate. Once the Inheritance Tax has been settled, the Executor or Administrator can apply for a Grant of Probate and thereafter distribute the estate to beneficiaries.

Probate and Inheritance Tax

The Executor or administrator must obtain a Grant of Probate in order to dispose of the estate assets and this cannot be issued until the IHT has been paid to HMRC. Probate is the right to deal with the deceased person’s property, money, and possessions. In Scotland this is known as Confirmation. There are also other very specific exemptions, such as the Estates of people who die while in active service (those in the armed forces, police, and paramedics). This exemption also applies if a person is injured on active service and has their death hastened by the injury and even if they have left active service at the time of their death.

Does a spouse pay Inheritance Tax?

The Inheritance Tax exemption rules for couples can be confusing. Married or registered civil partners do not have to pay any Inheritance Tax on any asset left by their spouse. When the second partner dies, the Estate qualifies for a married couple’s transferable allowance, which is the sum of two single people’s allowance, or £650,000 (providing none of the IHT threshold was previously used). The person who then inherits this Estate is only liable to pay tax on anything over the £650,000. This extra transferable element is known as Transferable Nil Rate Band (TNRB).

Do cohabiting couples have to pay Inheritance Tax?

There is no specific Inheritance Tax allowance or exception for cohabiting couples. If you’re not married, but own assets jointly, the situation can get complicated, especially where property is concerned. If you are joint tenants – meaning you both own all the property – and your partner left you everything in their Will, you would have to pay a 40% tax bill if the assets (including the property) exceed the single person Inheritance Tax threshold of £325,000. After your partner’s death the property would be owned by you in its entirety. If there was no Will, the property can still be transferred to you through the ‘right of survivorship’ and the same Inheritance Tax rules would apply. However, without a Will, any family members of your partner would have a right to claim their share of other assets left. In this case, administrators would be responsible for paying the tax bill.

When do you pay Inheritance Tax?

Inheritance Tax must be paid before Probate can be granted and before assets are distributed. The bill must also be paid within six months of the person’s death. If this deadline passes, HMRC will start charging interest and potentially penalties on the unpaid Inheritance Tax. The longer it takes for an IHT bill to be paid, the more interest is added. Currently the interest rate is set at 3.75% for late payments and HMRC will refund the Estate if it has overpaid IHT once Probate has been granted.

What do you pay Inheritance Tax on?

IHT is paid on the total value of the Estate left by the deceased. This includes bank accounts, pensions, properties, jewellery, vehicles, shares, jointly owned assets, and pay-outs from insurance policies. However, Inheritance Tax is worked out using the net value of the Estate. If debts, such as mortgages, funeral expenses, other taxes or expenses incurred in managing the Estate, need to be paid, then you’ll only pay IHT on the remaining amount that exceeds the Inheritance Tax threshold. As an example: If an Estate is worth £600,000 in total and there is £150,000 left to pay on a mortgage, plus £10,000 funeral expenses, then you’d need to pay Inheritance Tax on the remaining amount that’s above the threshold. In this case it would be payable at 40% of £115,000 (£46,000), assuming a single person Inheritance Tax threshold of £325,000.

Do you pay Inheritance Tax on a house?

Like the rest of an Estate, this depends on the value. Children or grandchildren that inherit a house also might not need to pay tax, as long as the value is under a certain amount. If the house that was the primary residence of the deceased has been left to direct descendants, then they can access a further tax-free allowance of up to £175,000 per person, which is in addition to the £325,000 single person Inheritance Tax threshold. This is called the ‘Residence Nil Rate Band’ (RNRB) and it can be passed on to children and grandchildren only. This means that Inheritance Tax may not be due on the first £500,000 of the Estate per individual. If the Estate passes to the surviving spouse, there is then a different allowance for Inheritance Tax when the second parent dies. Where the main property is left to direct descendants (or where they are to jointly own the property with their spouse), it is possible to have up to £1 million in tax-free allowance (£325,000 per person nil rate band and £175,000 per person RNRB). However, the £175,000 RNRB allowance only applies if the Estate that’s been left is worth less than £2 million. On Estates that are worth more than £2 million, the RNRB allowance will decrease by £1 for every £2 above £2 million that the deceased’s Estate is worth. If the property has been left to Beneficiaries who aren’t direct descendants of the deceased, then a tax bill of 40% will be liable for anything over the £325,000 single person Inheritance Tax allowance.

Do you pay Inheritance Tax on gifted money?

You do not pay tax on cash gifts, but there are strict rules. Besides, you may pay income tax on any additional income that arises from the gift, such as bank interest. While someone is still alive, they can gift as much as they want, to anyone they want, in the form of ‘potentially exempt transfers’ (PETs). However, if that person passes away, those gifts (or PETs) can then be included in the Estate of the deceased person. Under the current rules, if the gift is given before death, and the donor lives for more than seven years after any assets were given, it will be IHT exempt. However, if the donor dies sooner, tax will be charged on the gifts at various levels if the Inheritance Tax threshold is reached:

- Within 3 years of giving the gift – 40%

- Within 3 to 4 years – 32%

- Within 4 to 5 years – 24%

- Within 5 to 6 years – 16%

- Within 6 to 7 years – 8%

- After more than 7 years – 0%

Gifts use up the Inheritance Tax threshold before other assets such as property and values are calculated as what they were worth at the time of donation. Inheritance Tax must be paid on all gifts above the threshold if they are not exempt.

Are there any gifts that are exempt from Inheritance Tax?

The following are exempt from IHT:

- Gifts to your spouse or civil partner

- Gifts to charities

- Multiple gifts up to £250 a year to any other person

- Payments to help an elderly relative or minor with living costs

- Gifts worth in aggregate £3,000 or less in any tax year (excluding any £250 gifts, provided they are not to the same person)

- Gifts made seven years or more before the giver died

When a couple marry, people are also allowed to give the following wedding gifts without the money being included in the giver’s estate:

- Parents can gift cash up to £5,000

- Grandparents can gift up to £2,500 each

How to pay Inheritance Tax

There are a few ways to make an IHT payment and any amount over-paid can be reclaimed later from the deceased’s Estate once Probate has been granted.

How to pay inheritance tax before Probate

An Executor or Administrator can pay Inheritance Tax from their own bank account using the IHT reference number online or by telephone banking, CHAPS or BACS, and/or at the bank. They can also make the payment from any joint accounts held with the deceased.

How long does it take HMRC to process Inheritance Tax?

Before applying for Probate, you’ll need to fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days. You will usually have to pay some of the Inheritance Tax, if not all, before Probate will be granted. However, this can be claimed back from the Estate afterwards if it’s paid from your own bank account.

What happens if you can’t afford to pay Inheritance Tax?

Lots of estates are asset-rich and cash poor. This means they are at threat of being ‘locked’ because Inheritance Tax in the UK has to be paid within six months of death. When it comes to property, the only way to pay the Inheritance Tax (IHT) bill is from personal funds or with a traditional personal bank loan, as the property cannot be sold until the IHT has paid in full. Unfortunately, this is a common occurrence and is a classic ‘chicken and egg’ situation. The Executor (you) or Administrator needs the Grant of Probate before they can start disposing of the Estate assets in order to generate money to settle the IHT bill. However, it is not possible to get the Grant of Probate until the IHT is paid. In certain circumstances, assets such as property might take longer to sell. In this case, you can pay for your Inheritance Tax in annual instalments over 10 years, with the first due six months after the person’s death. You’ll only be liable for interest on that Inheritance Tax payment if you pay late. If you can’t afford to pay the Inheritance Tax in full, then interest will be charged on the total value of both the outstanding tax plus any instalments that haven’t been paid on time. Once you have sold the assets, any outstanding balance must be paid in full.

Inheritance Tax Loan

Each year an estimated 2,000 families are unable to afford the average up front IHT bill of around £220,000. If you find yourself saying “I can’t afford to pay Inheritance Tax”, you are not alone. Tower Street Finance has therefore designed a unique Inheritance Tax Loan product to help you pay when you can’t afford the Inheritance Tax. With this solution, there are:

- No risks to the executor

- No credit checks

- No charge on property

- No monthly repayments

- No requirement for a Will

We pay the money directly to HMRC and there is no risk or personal liability to you, the Executor. The loan is repaid from the Estate funds once it is ready to distribute. There is a fixed yearly interest rate of 19.6%. Interest that rolls up is capped at 30 months.

How to get a loan to pay Inheritance Tax from Tower Street Finance

Regulated by the Financial Conduct Authority, the Tower Street Finance IHT Loan is paid directly to HMRC, allowing families to start the Probate process and receive their inheritance. We have made it as easy as possible for you. Either get a quote or apply today. Our team is hand to help you and answer any questions on 0343 504 7100. We also offer an award-winning Inheritance Advance, a product for Beneficiaries who want to access their inheritance earlier than the nine to 12 months it usually takes.