Being a Beneficiary of a Will Explained

What is a beneficiary?

If you are a beneficiary of the Will of somebody who has recently passed away, you may be wondering what the next steps are, and when you might expect to receive your inheritance.

To find out what being a beneficiary means, read on. This guide takes you through what happens next and what you can expect.

Please be aware that this information applies to the rules for executing a Will in England and Wales. Please note that if you are based in another part of the UK, different rules apply.

What is a residuary beneficiary?

Who contacts beneficiaries of a Will?

Can a beneficiary be removed from a Will?

What happens when you jointly inherit a property?

Do beneficiaries of a Will pay tax?

What happens if a beneficiary dies?

Who gets paid first from an estate?

How long does it take to receive inheritance money in the UK?

How do I receive my inheritance?

What if a beneficiary is living in an inherited house before the inheritance has been finalised?

Who inherits if there is no Will?

How can Tower Street Finance help you with Probate?

What happens first?

Before you receive anything, probate will normally need to have been acquired first, giving executors the legal right to start disposing of the estate assets and then distributing the inheritance in line with the wishes outlined in the will.

It is an executor’s job to apply for probate. If you’d like to know more about the role of an executor, please see our guide to being an executor. We also have more information about how probate works in our useful probate guide.

There are exceptional circumstances where probate may not be required. For instance, if someone has died and only left savings, owned shares or money with others, or owned land or property as a joint tenant with someone who is still alive, it may not be necessary to obtain probate.

What does being beneficiary mean?

In the context of probate, a beneficiary is a person or entity who has been designated to receive a portion of the estate in a person’s Will. Beneficiaries may be named in a Will, or they may be included but not named. For example, “I leave to my grandchildren…”.

If you’ve been left an inheritance and you want to learn more about how inheritance tax (IHT) works, read our free inheritance tax guide.

What is a residuary beneficiary?

A residuary beneficiary receives the “residue” of an estate once all debts and expenses have been settled by executors.

Before the estate has been divided out among beneficiaries, any debts and expenses left by the deceased must be settled. After this takes place, any beneficiary of a Will who has been left a certain percentage of the estate then receives what’s left over, which is known as the “residue of the estate”. For this reason, the term “residuary beneficiary” is used to describe this type of beneficiary.

What are residuary beneficiaries’ rights?

Before probate has been granted, the beneficiary has a legal right to be informed that they are a beneficiary named in a person’s Will. They also have the right to be told how much they are entitled to receive; however, this will only be an estimate. A residuary beneficiary has the right to know who the executor is, and it is common practice for them to be given estimates of how long the probate might take.

Pecuniary beneficiaries are those entitled to receive a specific sum of money from an estate. For example, someone might write in their Will that they want their child to receive £20,000. Pecuniary beneficiaries will need to wait longer than beneficiaries of specific gifts in most cases.

Who contacts beneficiaries of a Will?

It is the responsibility of an executor to notify the beneficiaries, so the best way to find out if you are a beneficiary in a Will is to ask your deceased family member’s executor or solicitor.

If there are no executors named in the Will who are still living, then someone will be designated by the authorities as the “Administrator of the Estate” and the role of informing beneficiaries will fall to them.

When do beneficiaries of a Will get notified?

Under the law of England and Wales, there is no specific time frame for the beneficiaries to be notified about the Will. However, this should happen early on in the process, once the Will has been found to be legally valid and probate has been granted.

A beneficiary does have a legal right to know that they are a named beneficiary in a Will, and there can be serious legal implications if they are not made aware at all.

Are beneficiaries entitled to a copy of the Will?

Beneficiaries are not legally entitled to see the Will for themselves until after probate has been granted, at which point the Will becomes a public document available from the Probate Registry upon request.

Many people expect a Will to be formally read out to family members after the death of a person, but this is something seen on TV and film and not how the process is actually carried out. Only executors have a legal right to read a Will before probate has been granted. Anything else that executors choose to disclose to beneficiaries before this stage has been reached is at their discretion.

Once probate has been granted, executors are supposed to keep accounts and be prepared to show these to any beneficiaries who ask to see them.

Can a beneficiary be removed from a Will?

Beneficiaries can be written in and out of a Will while the person who owns the estate is alive. However, after the estate owner has died, any named beneficiaries cannot be removed.

What happens when you jointly inherit a property?

If you’re a beneficiary who jointly inherits a property, you need to agree on what to do with it with the other beneficiaries. Between you, you must decide if you want to sell it, live in it, or rent it. However, reaching a decision all beneficiaries are happy with can often be easier said than done.

Do beneficiaries of a Will pay tax?

Beneficiaries do not have to pay tax on the inheritance they receive. However, if inheritance tax is due on an estate, this will have been settled before an inheritance is distributed to beneficiaries. It is the responsibility of the personal representative or executor to pay inheritance tax.

Any profit that is earned from an inheritance may be subject to income tax, such as in a situation where they make dividends on shares or rental income on a property.

Do you pay stamp duty when you inherit a property?

If you inherit a property, you don’t pay stamp duty, income tax or capital gains tax on it when it is transferred to you. But you may have related taxes to pay, such as capital gains tax, should you decide to sell the property.

However, if inheriting a property means you own two homes, you will have to nominate one as your main home. You must tell HMRC about this within two years of inheriting the property and if you don’t inform HMRC and then sell one of the properties, HMRC will decide which is the main residence and charge capital gains tax on the other property.

What happens if a beneficiary dies?

In the UK, if a beneficiary dies before or shortly after the testator – the person whose Will it is –the benefit is usually considered to have lapsed, and the estate of the beneficiary will not receive anything. That being said, sometimes there are exceptions to this rule.

Typically, whatever the deceased beneficiary would have received will fall back into the residuary estate and will be redistributed out among any other beneficiaries.

What if a beneficiary dies after the testator?

Many Wills contain a survivorship clause stating that a beneficiary needs to survive the deceased by a certain length of time in order to inherit. The period for this is usually 28 days. If a beneficiary is alive for the duration of this period but subsequently dies before the inheritance has been received, it will pass into their own estate and be inherited by their beneficiaries.

Who gets paid first from an estate?

Before the inheritance can be received by the beneficiary, it is the responsibility of executors to pay off any outstanding payments the deceased person owed. This may include utility bills and inheritance tax. The funeral costs will also need to be paid from the estate.

Following this, “pecuniary legacies” should be paid out. These are gifts of specific amounts of money or specific items, like jewellery. Once this has been done, the residuary estate can be paid out.

How long does it take to receive inheritance money in the UK?

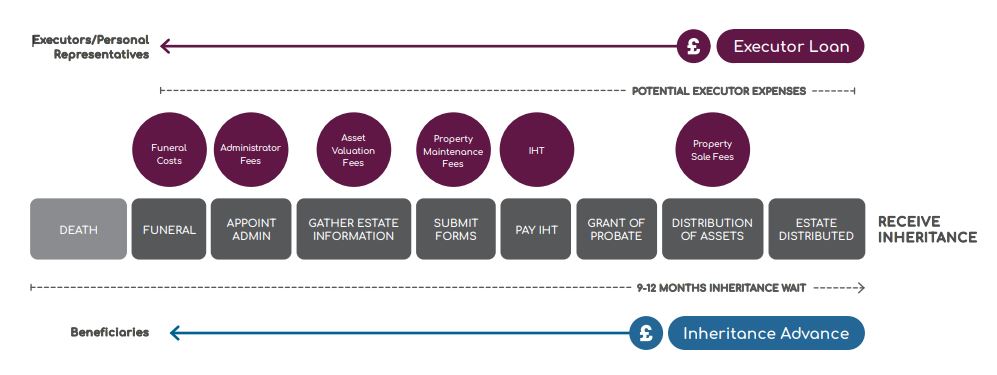

On average, it takes about nine to 12 months for beneficiaries to start receiving their inheritance, although this can vary depending on the complexity of the estate. The lengthiest part of the process is usually waiting for probate to be granted. After this, it can typically take around six months for the estate to be distributed. If there is no property to be sold the process can be much quicker.

How do I receive my inheritance?

Once probate has been granted, the executor has legal control over the estate, and this is when it is possible for beneficiaries to receive their inheritance.

However, in order to receive probate, any inheritance tax that might be due has to be paid to HMRC. This means that executor needs to find the money to pay the IHT before they can access the estate.

To help executors claim their inheritance and be granted probate to distribute it according to the wishes expressed in the Will, Tower Street Finance has created a unique product. Our Executor Loan helps executors (or personal representatives, in the event there is no Will) to pay the IHT so that they can gain access to the estate.

Can I get my inheritance early?

Before we designed the Inheritance Advance product, beneficiaries could only receive their inheritance once probate had been granted and all the assets in the estate sold. However, our Inheritance Advance is a unique, award-winning financial product that enables beneficiaries to access up to 60% of their inheritance before probate has been granted.

There are no credit checks, no charge over property, no personal liability, and no monthly repayments. The loan is repaid from the estate funds once they are ready to distribute.

Want to learn more about accessing your inheritance early? Get in touch with Tower Street Finance.

What if a beneficiary is living in an inherited house before the inheritance has been finalised?

It is common for somebody to die and leave a beneficiary living in their property before they have technically inherited it.

If the property has a mortgage, the beneficiary will need to contact the mortgage provider and explain the situation. Most mortgages extend a grace period where payments are suspended until the estate has been distributed.

Even if somebody inherits a property they don’t live in, they automatically become responsible for meeting any mortgage payments.

Another possible scenario is that a beneficiary may inherit a property that somebody else is living in. Ideally, arrangements should be made for the occupant to vacate the property. If this isn’t possible, it may be necessary to apply to the court either for possession or for an order for sale. It’s possible to make a claim for occupation rent to be paid by the occupant in the meantime.

When there is a dispute over a property, it can be useful to speak to an inheritance dispute lawyer about it.

Who inherits if there is no Will?

If somebody dies and doesn’t leave a Will, the rules of intestacy are used to decide who benefits from the estate. This also applies if somebody has made a Will but it is found to not be legally valid.

Any partner who is married to, or in a civil partnership with, the intestate person at the time of death will be eligible to inherit. If the deceased hasn’t left any surviving descendants, this partner will inherit the whole estate.

Should there be surviving children, intestacy rules dictate that if the estate is worth more than £270,000, it will be divided between the living partner and any surviving children. In this circumstance, the partner would inherit:

- All personal property and belongings

- The first £270,000 of the estate

- Half of the remaining estate

Each instance of intestacy can be quite unique, as family circumstances differ widely from person to person. For more information about how intestacy rules are used to decide who inherits and how an estate is apportioned out among them when no will has been left, please see our guide to intestacy rules.

If you are an executor or beneficiary of a Will and you have run into financial challenges during the process of probate, we may be able to offer some helpful solutions.

How can Tower Street Finance help you with Probate?

If you are an executor, you may need a little extra help covering the cost of a funeral, paying professional fees for the probate application and the cost of valuers and surveyors, paying for repairs and maintenance to estate property or paying the costs associated with clearing a house.

If this is you, why not fill out our online form and see if you could benefit from our Executor Loan product? There are no credit checks involved and no monthly repayments; with the loan instead being repaid from the proceeds of the estate.

And if you’re embroiled in an inheritance dispute, our Inheritance Dispute Funding facility could help you cover the legal costs of pursuing your case, should you be eligible. There are no credit checks associated with this facility either and repayment is simply taken from the estate. If we assess your case and believe it to have a strong chance of success, you could be eligible, so why not apply online today?

If you’d like to speak to one of our friendly advisors, you can also call us on 0343 504 7100 or send an email to contact us.