Being an Executor of a Will Explained

What is an Executor of a Will?

The Executor of a Will is named in the Will as responsible for dealing with the estate, including distributing inheritance to Beneficiaries.

If there isn’t a Will, or the Executor(s) aren’t willing to act, or are no longer capable due to physical or mental health issues, then an administrator (or Personal Representative) is appointed to carry out the role.

Who can be an Executor of a Will?

What power does the Executor of a Will have?

Are Executors of a Will liable for Inheritance Tax?

What is the Executor of a Will entitled to?

Can the Executor of a Will also be a Beneficiary?

Can an Executor also be a Witness to the same Will?

How does an Executor distribute money to Beneficiaries?

How long does an Executor of a Will have to settle an estate?

What happens if an Executor of an Estate dies?

Can the Executor of a Will withhold money from the Beneficiaries?

What happens if the Executor does not follow the Will?

Can an Executor change a Will after death?

What happens when joint Executors disagree?

Who can be an Executor of a Will?

Anyone aged 18 or above can be an Executor. Normally two Executors are named in a Will, but up to four Executors can act at a time.

What power does the Executor of a Will have?

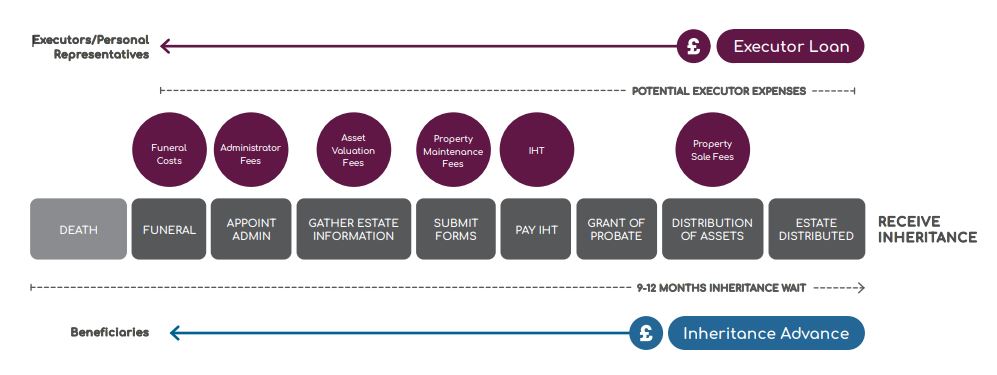

Executors are responsible for carrying out the instructions written in a Will, and they have several responsibilities such as:

- Arranging the funeral – if the Will specifies

- Collecting all assets, including property and money due to the estate of the person who has passed away

- Applying for the Grant of Probate – if needed

- Paying any debts owed by the deceased and settling any inheritance tax due

- Distributing the estate proceeds to the people named as Beneficiaries in the Will once Probate has been granted.

Does the Executor of a Will have to apply for Probate?

Anything left by the deceased such as money, property and personal possessions are known collectively as their ‘Estate’.

An Executor of a Will needs to calculate the total value of the Estate. Typically, if an Estate exceeds £15,000, Probate must be granted. Only once the Grant of Probate is issued will the Executor have the legal authority to carry out the instructions left in the Will.

Are Executors of a Will liable for Inheritance Tax?

It is the responsibility of the Executor, or Personal Representative, to manage any Inheritance Tax liability. Appropriate IHT forms need to be completed and the bill needs to be settled with HMRC before the Estate can be released.

In other words, the Executor needs to pay the inheritance tax bill, often out of their pocket, before they can claim it back from the estate.

If you’re an Executor and you’re struggling to pay inheritance tax, Tower Street Finance can help you. Find out about our IHT Loan, our product designed to help you pay inheritance tax.

How do Executors pay Inheritance Tax?

If the estate is liable for Inheritance Tax (IHT) the Executor must settle the bill within 6 months of the deceased’s passing. Inheritance Tax needs to be paid before the estate can be distributed to Beneficiaries.

Find out more about how to pay Inheritance Tax or get in touch with Tower Street Finance today.

What is the Executor of a Will entitled to?

An Executor of a Will has the authority to manage the affairs of the Estate in whatever way they determine best for fulfilling the deceased’s wishes.

The Executor is usually entitled to receive compensation from the Estate, the amount of which depends on the situation.

What expenses can an Executor claim?

Executors can claim back any out-of-pocket expenses from the Estate. This may include Probate Court fees, Inheritance Tax or expenses to maintain any property. It’s recommended that Executors provide Beneficiaries with receipts and invoices for these payments.

If the Will names a professional Executor, then they are entitled to charge a fee for their services. However, if the Beneficiaries are not happy with the fees, they have the right to request that the named Executor renounce their role. In this situation, a substitute Executor would step into the role of Executor.

Can the Executor of a Will also be a Beneficiary?

There is no rule to prevent Executors from also being Beneficiaries. Although it is normal and legal to name the same person as an Executor and a Beneficiary in a Will, sometimes an Executor of a Will is just that and not a Beneficiary.

Can an Executor also be a Witness to the same Will?

Yes. An Executor can be one of the two official Witnesses needed to validate a Will so long as they are not also a Beneficiary.

How does an Executor distribute money to Beneficiaries?

Once the Grant of Probate has been issued, Executors can distribute the estate following the instructions left in the Will.

Before anything can be distributed the Executor must settle any outstanding debts. Once this has been done, whatever is left can be distributed to Beneficiaries. There is a strict order of priority for distributing the estate:

- Pecuniary legacies, which includes gifts of specific sums of money

- Residuary estate, which is any money remaining.

What happens if Beneficiaries want to access Inheritance sooner?

If Beneficiaries of a Will want or need access to an Inheritance sooner than the Grant of Probate will allow, Tower Street Finance’s Inheritance Advance is a unique product that allows access to up to 60% of the inheritance more quickly. For more information about Inheritance Advance, get in touch with Tower Street Finance.

Does an Executor have to show accounting to Beneficiaries?

Yes. The Executor of a Will is legally required to keep track of any costs and be able to provide evidence of any estate transactions.

How long does an Executor of a Will have to settle an estate?

On average, it can take anything from 9 to 12 months for the Executor of a Will to settle an Estate, or longer for complex cases.

Pecuniary legacies should be paid out within a year of the death. This is known as the ‘Executor’s year’. If the Executor isn’t able to pay the pecuniary legacies within that timeframe, then Beneficiaries can claim interest.

What happens if an Executor of an Estate dies?

If a Will’s Executor dies or is unable to serve for any reason and if there isn’t another Executor named on the Will, in England and Wales the Non-Contentious Probate Rules will apply. These rules state that a residuary Beneficiary can act as an Executor. The named Beneficiaries will need to agree on who the new Executor of the Will is.

What happens if the Executor dies after Probate is granted?

If an Executor dies after Probate has been granted, the Executor of their Will need to take on the role of administrating the first Estate – this is called ‘Chain of Representation’.

This may also mean that the new Executor needs a new Grant of Probate. If the deceased Executor didn’t leave a Will, the Rules of Intestacy will decide who deals with the estate of the deceased Executor.

Can the Executor of a Will withhold money from the Beneficiaries?

The Executor must follow the instructions left by the deceased in their Will. However, there are some exceptional circumstances where an Executor can withhold money from the Beneficiaries:

If unknown debtors come out of the woodwork the Executor can delay settlement with Beneficiaries for up to six months until any debt is settled.

If the Executor has concerns over the welfare and wellbeing of a child Beneficiary, they can apply to the court to withhold distributing inheritance until the child turns 18 in England or 16 in Scotland.

If the Executor believes that a Beneficiary is vulnerable, then the Executor can pay the inheritance into a discretionary trust.

What happens if the Executor does not follow the Will?

If you discover that an Executor or Executors have not carried out their duties properly you can take legal action against them.

Can an Executor change a Will after death?

Surprisingly, the answer to this question is yes. However, an Executor can change a Will after death only if any Beneficiaries who would be worse off by the change agree.

What if I don’t think the Executor is acting in the Beneficiaries’ best interest?

Executors need to follow the law and the instructions left in the Will. If an Executor attempts to withhold bequests or act against the interest of the Beneficiaries, such as perhaps selling a property from within the estate at a low price the Beneficiaries are unhappy with, then they can be taken to court.

What happens when joint Executors disagree?

Usually, two Executors are named on a Will but there can be anything up to four. Multiple Executors need to jointly agree as they share all the responsibilities – and that’s where problems can arise. If Executors can’t agree they need to renounce their role or be removed via the Probate Court.