The True Cost of Inheriting Property in 2023

We’ve explored what costs you can expect if you inherit a property this year.

For many people, their home is the most valuable asset they own in their lifetime, and therefore inheriting a property is typically considered a great privilege.

However, while finding out you’ve been left a home in a loved one’s Will can be a very pleasant surprise, many people are unaware of the associated costs that come with this generous gift.

With this in mind, we’ve looked into the various expenses that you may be expected to cover if you’re left a property in a Will – from house clearing to property insurance.

It’s worth being aware that our estimated costs are for an average-priced UK home, and do not include inheritance tax as this varies a lot depending on the individual’s total estate value (which includes things such as shares, cash, jewellery, cars etc alongside property).

Inheriting a home

According to a recent survey we ran, the majority of people in the UK (72%) expect to leave some sort of inheritance to family and friends when they pass away.

Children are the most likely recipients of inheritance, with two thirds (64%) planning to name their kids as beneficiaries in their Will.

Over half of Brits (58%) also said they expect to be left at least one residential property in their lifetime, and for those who have already been left the keys to a home, the majority (70%) inherited this from their parents.

‘I expect to inherit one or more residential properties in my lifetime’ (by region)

- Northern Ireland (75%)

- Scotland (69%)

- South West England (63%)

- Wales (59%)

- South East England (58%)

- Northern England (54%)

- Central England (53%)

Some generations – particularly Gen Zs (aged 18-24s) Millennials (aged 24-35) are even relying on inheritance to get on the property ladder – either by being left a home directly or using inheritance money for a deposit. Around one in eight (16%) in these age brackets told us this was the only way they’d expect to be able to afford to buy a home of their own.

Overall, HMRC reports reveal that on average, property makes up 54% of the average estate value total at death, and the current average home price in the UK is sitting at around £296,000.

Deciding to keep or sell a property you’ve inherited

If you’ve been left a property in a Will then deciding what to do with it can be tricky, as it’ll naturally depend on your personal circumstances, as well as the property itself.

In our recent survey, if left a property in a family member’s Will (in the next 12 months), 39% of UK adults told us they’d sell it, while 34% said they’d keep it.

Men are more likely to keep a property they inherited than women (37% versus 31%), and 18-24s are also the most likely to keep a property they’ve inherited (65% would keep it), followed by 25-34s (45%).

If you decide to keep the property then you may choose to live in this yourself, use it as a holiday home or rent it out to generate some additional income.

Selling it is likely to lead to a cash windfall down the line, but this can of course be a long process.

Either way, whether you’re selling the property or keeping it there are various costs you may be expected to cover.

Costs you may need to cover, if you inherit a property

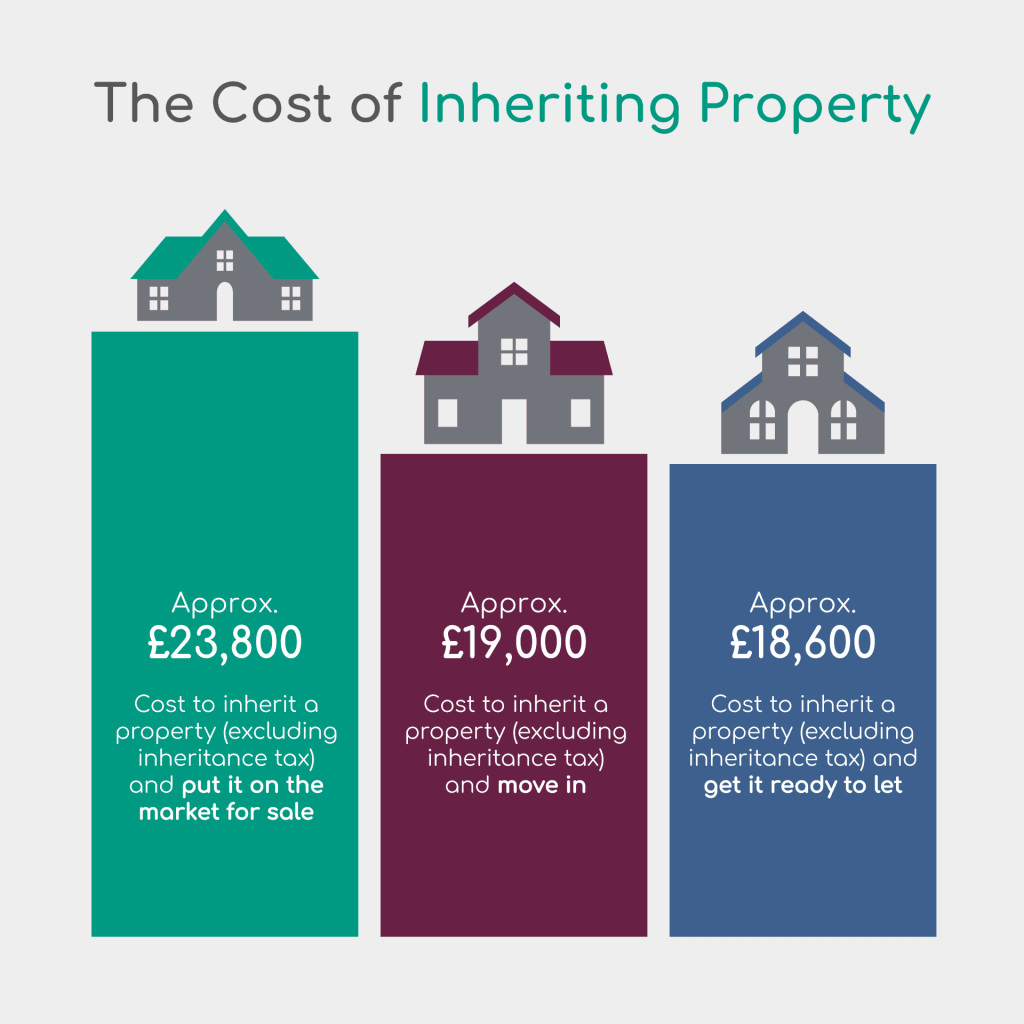

While these will of course vary from person-to-person (based on the home and what you decide to do with it), we estimate that – not including inheritance tax – you’ll need to pay out around £20,000 in expenses before you can move in, let or sell the property.

- Cost to inherit a property (excluding inheritance tax) and put it on the market for sale: £23,800

- Cost to inherit a property (excluding inheritance tax) and move into it: £19,000

- Cost to inherit a property (excluding inheritance tax) and get it ready to let: £18,600

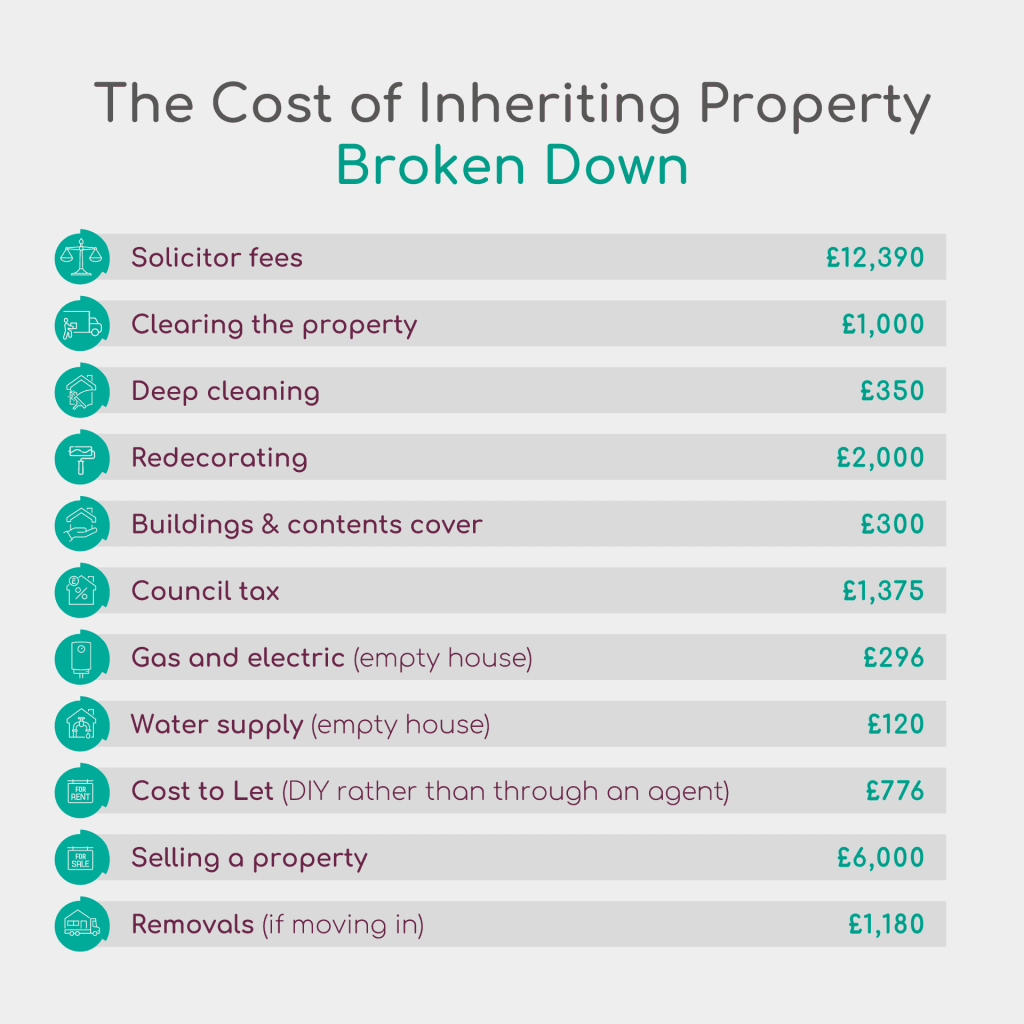

Solicitors’ fees are typically the largest cost, averaging around £12k for a typical property.

Clearing the property, deep cleaning it and decorating it (painting only) will cost around £2,800 for a typical home, but of course this can be a lot more depending on the work that you decide to or need to tackle.

For example, redecorating (just painting) usually costs around £400-£500 per room. If you decide to also replace flooring, fixtures and fittings, then the bill will be a lot higher. Jobs such as rewiring, new windows, doors and insulation may all be considered pretty essential and can each cost several thousands of pounds.

Even if you plan to sell a home without doing anything to it, an empty property also comes with costs you may not be aware of. Property insurance, council tax, and standing charges for utilities (gas, electrics and water) will all apply, costing around £2,000 for the average home during the typical probate process (which is usually 9-12 months).

Not all of these are likely to need paying at the same time, with approximately £5,000 worth of costs likely to need paying within the first couple of months, and the majority being midway or at the end of the process.

Upfront costs (approx. £5,000):

- Clearing the property (£1,000)

- Deep cleaning (£2,000)

- Redecorating (£2,000)

Mid-Way Costs (approx. £15,000):

- Council Tax (£1,375)

- Gas/Electric (£296)

- Water (£120)

- Building & Contents Insurance cover (£300)

- Solicitors’ costs (£12,390) although they may accept payment at the end of the process

Back-end Costs (between approx. £1,000 and £6,000)

- Cost to Let (£776)

- Cost to Sell (£6,000)

- Removals (£1,180)

Covering these unexpected bills

With the costs coming out so high, it’s perhaps not surprising that almost two thirds of Brits (64%) told us they’ve not be able to afford this without having to take out a loan – and with interest rates currently being so high, then many will be keen to avoid this debt.

‘If I inherited a property in the next 12 months, I would not be able to afford the associated costs in full’ (by age)

- 18-24-year-olds (66%)

- 25-34-year-olds (64%)

- 35-44-year-olds (66%)

- 45-54-year-olds (72%)

- 55-64-year-olds (63%)

- Over 65-year-olds (53%)

But is there anything you can do to reduce these bills? Well, there are a few things that could help you get the costs down. For example:

- Shop around for a solicitor. If a specific Solicitor wasn’t dictated in the Will, and you are named as the Executor, then you may be able to shop around to ensure you receive the best value for money. Solicitor fees do vary, but it’s important to read reviews or seek our personal recommendations to ensure you’ll still get a good service before you switch.

- Clear the property yourself. Hiring a van and clearing a property yourself can save you a lot of money, but keep in mind that this is often a strenuous, emotional and time-consuming job. You also need to ensure you’ve done research into how much you can take to your local tip as this varies by council. Sites like Freecycle can be a good way to quickly get rid of furniture that you don’t think are worth selling but are still in a good condition. The British Heart Foundation also offers a free furniture collection service, but check their terms and conditions first as some items need to have their original fire safety tags on.

- Shop around for storage. Once cleared, there may be some larger items that you need to put in storage temporarily. Again, the cost of storage varies a lot so it’s worth doing your homework to see where could be the best option for you, and your items.

- Tackle some home improvement yourself. If the property is in a reasonable condition and maybe just needs sprucing up with a fresh lick of paint, then you could save a fair bit of money by doing this yourself too. If you’re putting the property on the market for sale or rent, then painting everything white or neutral shades is typically recommended by property experts. Before ripping out carpets, see if they could just do with a good clean. It’s cheap and easy to hire a carpet cleaner for 48 hours and this can often make a world of difference. Kitchens, bathrooms, front doors and gardens can also be spruced up with a bit of hard elbow grease. From a fresh lick of paint to new grouting, these jobs can often be done without an expert saving you money on professional fees. Don’t tackle things like electrics, structural work or plumbing unless you’re training and very confident you know what you’re doing though – some jobs are best left to the experts.

- Shop around for insurance. Even an empty home will need insuring. Use comparison sites to shop around for a good deal, keeping in mind the value of the property (and fixtures and fittings) and any potential issues that could be more likely to occur such as flooding / leaks.

Don’t forget about inheritance tax

Our estimated costs above don’t include inheritance tax, which you may also need to pay. The size of the IHT bill will vary according to the individual’s total estate value.

According to the HMRC, around a third of estates at death (that include a property) break the inheritance tax threshold, meaning that many will face additional costs to cover this too.

Around a quarter (23%) of Brits told us they don’t know who is responsible for paying inheritance tax though. If you’re not sure if you could be liable for this, then it’s best to speak to the solicitor who is handling the probate process for the deceased.

Unpaid IHT bills can lead to fines, and it has been reported that HMRC are currently cracking down on unpaid inheritance tax, so don’t be caught unawares.

Conclusion

It’s clear that while inheriting a home is likely to be a fantastic privilege, it’s not simply a case of getting the keys and either moving in or getting it on the market.

The typical probate process in the UK takes around 9-12 months, and there will be various costs that need covering during this time (such as standing charges for electricity, council tax, insurance) in addition to solicitors costs and potentially inheritance tax too.

We know that inheritance is a confusing topic so we’re here to help you solve these types of inheritance problems and support you in getting some of your inheritance quicker.

Please contact us via phone or email if you have questions about any of our Probate Lending solutions.