Turn that Blue Monday frown upside down

According to a university boffin the combination of miserable weather, short days and the arrival of unpaid bills makes today (18th January) officially the most depressing day of the year.

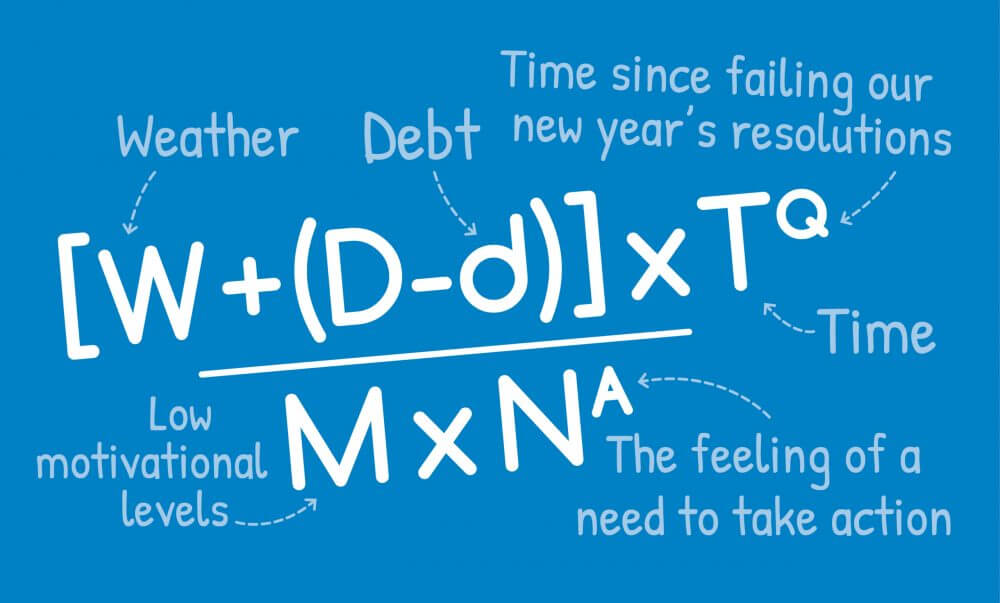

The date, gloomily titled Blue Monday, was calculated using many factors, including weather conditions, debt levels and the difference between debt accumulated and people’s ability to pay, time since Christmas and low motivational levels.

Today is also when we’ll be statistically most likely to fall off the New Year resolution wagon too.

If you weren’t already feeling a little disheartened before you knew today was Blue Monday, you might be now. And I am sure the current lockdown isn’t helping either!

But wait, it’s not all doom and gloom. At least, I don’t think it should be.

The calculations carried out by the university professor also revealed that today is when most people feel the need to make a positive change and to take action to turn something around that is causing them stress and worry.

We can’t do anything about the weather. We can’t even hop onto a plane to sunnier climes at the moment. However, we can try and take control of our finances.

Since the start of the year we’ve had a surge of calls from customers wanting to do just that with the help of our Inheritance Advance product.

Inheritance Advance is an award-winning product that enables beneficiaries to access to some of their inheritance earlier.

Of course, by applying for Inheritance Advance, we know that Blue Monday could already be even harder for these customers because they’ve recently lost loved ones.

But we’ve found that many of our customers find comfort in being able to use an inheritance to create a positive change. Whether that’s by paying off some of those unpaid bills that are causing extra pressure and worry, by starting new projects such as moving house, buying a holiday home or house renovations, or simply a treat to cheer themselves up.

In fact, we recently asked 2,000 UK adults how they would spend an inheritance and the number one thing people would spend it on was paying off their mortgage (21 per cent).

A further 19 per cent said they would use it to pay off personal loans and credit card bills and 11 per cent said they would wisely invest it into their pension pot.

Twelve per cent said they would buy a new home, a further 7 per cent said they would buy a holiday home and 13 per cent would use the money to carry out home improvements.

With Inheritance Advance there are no credit checks, no charge over property, no personal liability, no monthly repayments and a fixed monthly interest rate. And you can use the money for anything.

The loan is always repaid from the estate funds once the estate is ready to distribute. There is a 2 per cent origination fee (capped at £1,500), which can be added to the loan, and a fixed yearly interest rate of 19.6 per cent. Interest roll up is capped at 30 months.