Just inherited a home? Here’s everything you need to know about what comes next

Most Brits expect to inherit a property in their lifetime – but many don’t know the process, and are unaware of the hefty costs they can face.

Over half of UK adults (58%) expect to inherit at least one residential property during their lifetime, but many are unaware of what the Probate process looks like, how long it takes to get the keys, and if there are any associated costs.

To help, the Probate Lending experts at Tower Street Finance have explained what the journey looks like, and what to expect depending on what outcome you choose.

The Inheritance Stages

- Month 1: A solicitor is appointed, and the Will is read

- Months 2-4: The solicitor gathers information to submit forms and pay inheritance tax

- Months 4-7: This is typically when you are waiting for the paperwork to be processed and for ‘Probate to be granted’

- Months 7-12: Assets (cash / property etc) can be sold, and proceeds distributed

1. You’ve just found out you’ve been left a property in a loved one’s Will

So, you’ve just had word that you’ve been left a property in a Will. If you were named as the Executor in the Will, then you’ll be responsible for sorting out the estate of the person who has passed away. That means gathering and evaluating their ‘assets’, paying any outstanding bills and then finally distributing what’s left. A solicitor can help with this, so don’t panic.

If you’re the Executor of the estate, then you’ll need to get unoccupied property insurance while it’s empty, which covers you in case of damage or criminal acts. You may also need to cover standing charges for gas, electricity and water supplies.

Solutions such as Estate Expense Funding can help Executors cover these costs – and many others – you might face during this difficult time.

If you were named as a beneficiary in the Will, then you’ll be given the specific ‘asset’ you’ve been left only after Probate has been granted which takes an average of 4-7 months. The Executor of the estate may get the keys to any property quicker, but depending on what you plan to do next, you may still face some further delays.

If you were left a share of a house, then you and the other beneficiaries will need to decide how best to divide things up between you. Often selling the property is considered the simplest option, as once it’s sold you can then split the proceeds between you. However, you can’t sell up until the Grant of Probate has been obtained and you will only get the proceeds once the entire Probate process is complete.

2. You’ve found out the property has a mortgage

If you’re the Executor of the estate, then you may be responsible for paying the mortgage on the property during the Probate period. If you haven’t heard from the lender but you’re fairly sure the property wasn’t owned outright, then it’s worth checking with them.

Most mortgage providers will have a grace period during which repayments are suspended while the estate gets sorted out. This may not last for the duration of the Probate process though, so you may be required to cover some repayments.

Once the property is granted legally yours, you will need to pay the mortgage, even if you don’t live there.

Sometimes a life insurance policy will cover the cost of an outstanding mortgage, but if this isn’t the case then typically the two options available to you are to either sell it and use the proceeds to pay off any remaining mortgage or take out a new mortgage in your name.

3. You’ve decided to keep the property and live in it

If you’ve decided to keep the property, have the keys, and are in the process of setting up a mortgage in your name, then you should consider registering the transfer of ownership to you with Land Registry. You don’t have to do this, but it will make things easier down the line. It’s best to take advice from a solicitor on this.

If inheriting a home means you now have two or more in your name, you should also contact HMRC to tell them which is your ‘main’ home. If they don’t hear from you, they’ll make an assumption based on the info they have, and this could be incorrect and cause you issues later.

You don’t need to pay stamp duty on an inherited property (unless you sell it or have bought out someone else’s share), but you may need to pay inheritance tax. This is organised by the Executor and is usually taken from the estate before assets are distributed. However, if there isn’t enough cash or other assets to cover the tax bill then any Beneficiaries may be asked to contribute (if you don’t want to sell equity in the property you’ve been left). Solutions such as an IHT loan can help with this.

The tax rules are a little complicated, so it’s best asking a financial advisor to talk you through your options. For example, there is no IHT (inheritance tax) due on an estate that’s worth less than £325k in total, and if the property is left to children or grandchildren (including adopted, foster or stepchildren) then the tax threshold increases to £500k.

If the property is abroad then that adds another layer of complication as the estate may also be liable to pay taxes in the country where the property is located, as well as in the UK. However, the UK government has signed many double taxation treaties, which should allow you to claim back any double payments. Again, a solicitor can help with this.

Of course, before you move in you’ll also need to clear the property and some redecoration may also be required, both of which are likely to incur some cost and can be quite emotional depending on your relationship with the person who passed way.

While it will vary, typically the time it takes between the Will being read and being able to move into a property you’ve inherited – if there isn’t a mortgage on it – is around six months. If there is a mortgage, then it could take longer.

4. You’ve decided to keep the property and rent it out

In addition to the above steps, there are also some other things that need doing with a property you intend to rent out.

If it was already a rental property with tenants, then you need to decide if you wish to continue letting to them. You’ll need to check the terms of their current rental contract, and you may need to get a new contract drawn up that names you as the landlord.

If this is a new rental property, then you’ll need to ensure you’ve read the UK government’s rental checklist, and completed any actions from this. This is likely to include getting a new EPC rating for the property and ensuring it complies with safety regulations.

You’ll also need to declare any rental income you get from the property via a self-assessment tax return. Income tax will then be due each year, but the amount will depend on your total income.

Again, while it will vary depending on your situation, you should expect a wait of 6-9 months between finding out you’ve inherited a property and being able to rent it out. This is partly because you may want to put a ‘buy to let’ mortgage on the property and you cannot do this until Probate has been granted.

5. You’ve decided to sell the property

Selling the property can feel like the easiest option – especially if it was left to several people.

You won’t be able to sell the property until the Grant of Probate has been obtained, unless your name is already on the deeds, so that means you’re potentially looking at a 4-7 month wait to sell up, or maybe even longer depending on how complex the paperwork is, with the proceeds being received after 9-12 months when the entire Probate process is complete.

It’s not uncommon to put the property on the market whilst waiting for the Probate process to be finalised, to allow for a quick sale once completed. However, your solicitor may caution against this as it’s hard to predict how long it will take for Probate to be granted due to delays at the Probate Office. If you find a buyer and aren’t yet able to complete, the sale may fall through.

Regardless of what timing plan you’re working to, you’ll need to get the property cleared and then invite estate agents to come and value it. If you’re not the Executor of the estate, you’ll need to ask them to give you the keys as they’ll have control over these.

Once you do have access, you may want to seek expert advice on any jobs to do that may increase its value and saleability prior to it being listed.

It’s worth bearing in mind that if you sell the property and its value has increased since you inherited it, then capital gains tax is due on the profit (but only if you didn’t live there and named it as your main residence).

You get a capital gains tax allowance of £12,000 per year, and then the tax is 18% on any profits above this (if you are a basic-rate income taxpayer – if you’re on a higher rate then you may pay more).

If the profit on the inherited property is less than £12,000, you won’t have to pay capital gains tax unless you have already used up your annual allowance.

You may also need to pay stamp duty when you sell, if the inherited property was not your main home or first home.

Being aware of the costs

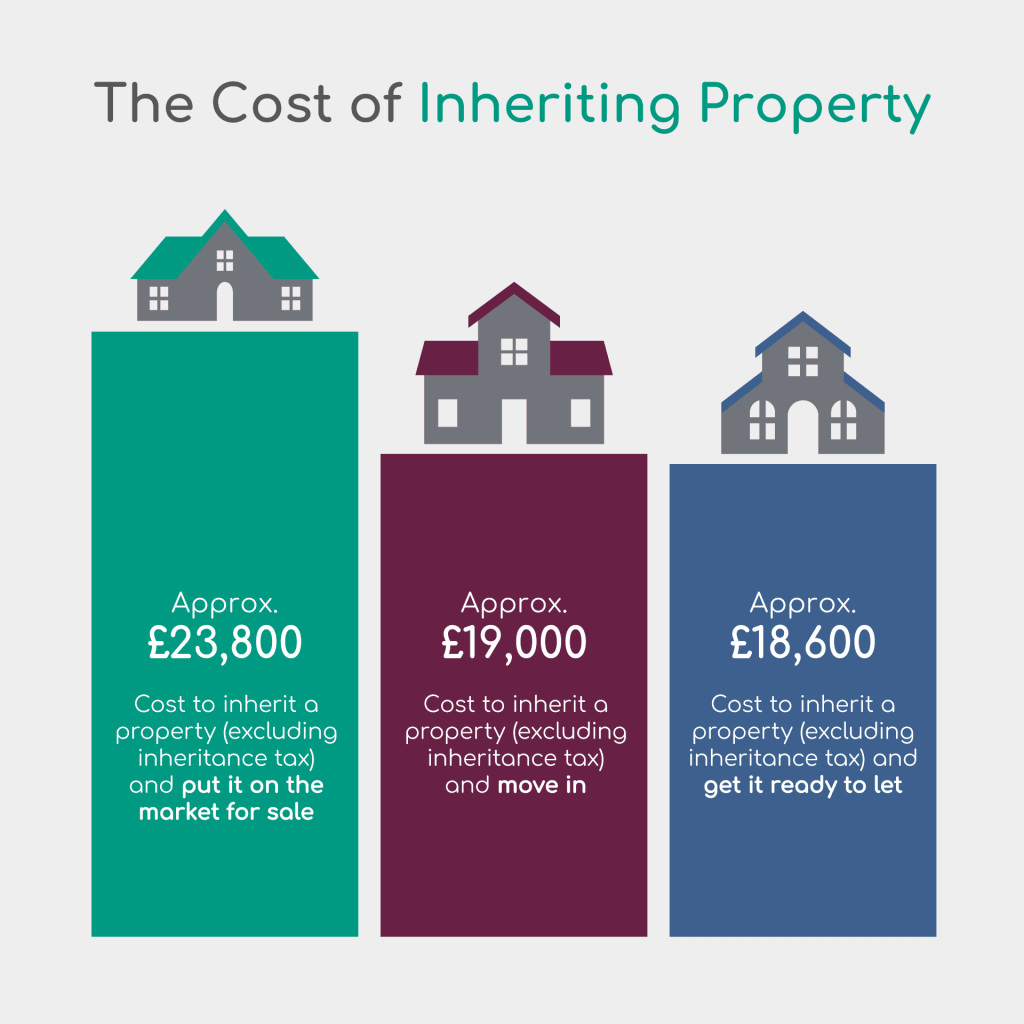

Overall, anyone that is left a property in a Will should expect to foot a bill of around £20,000 for an ‘average’ sized and valued property – and that’s not including inheritance tax, stamp duty or capital gains tax.

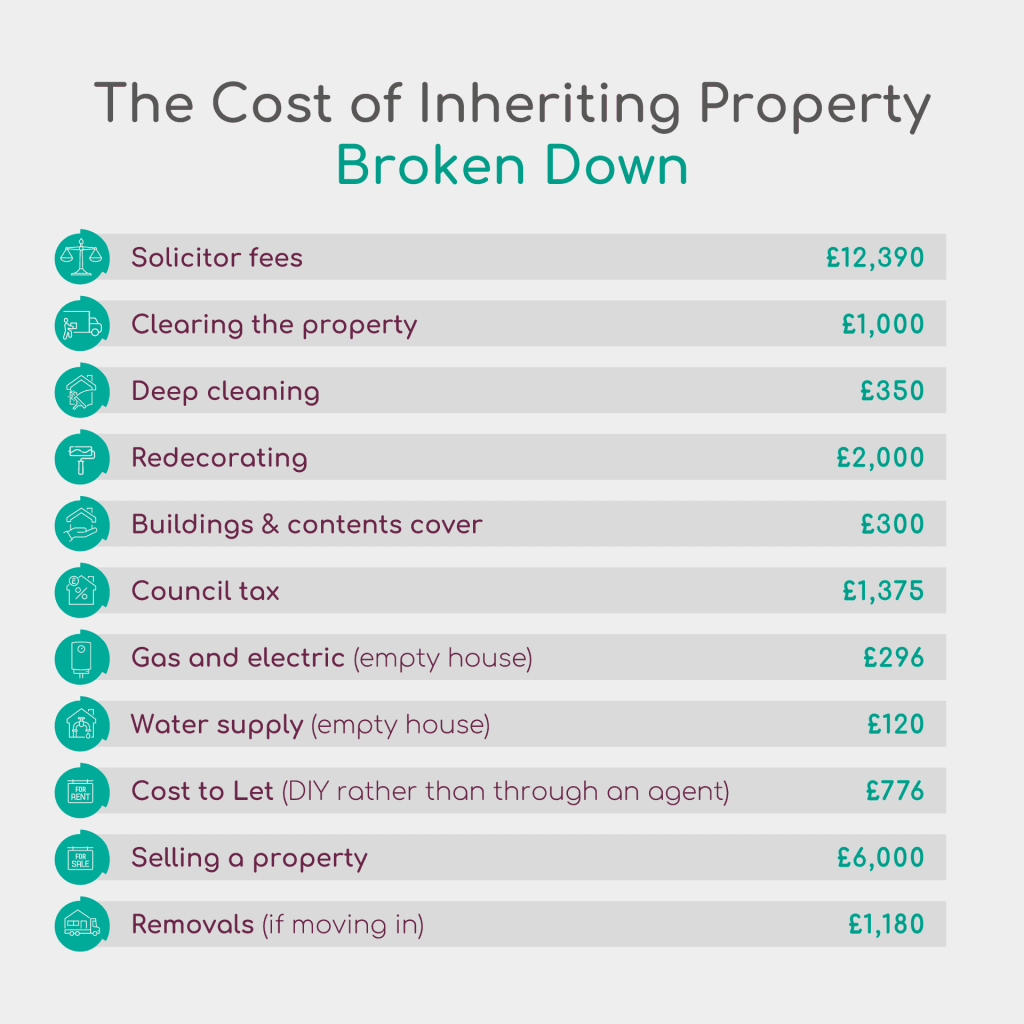

This cost – which is expected to rise over time – is made up of expenses such as house clearing, basic redecorating, standing charges for energy and water, insurance and solicitors’ fees.

It varies slightly depending on what you decide to do with it.

- Cost to inherit a property (excluding taxes) and put it on the market for sale: £23,800

- Cost to inherit a property (excluding taxes) and move into it: £19,000

- Cost to inherit a property (excluding taxes) and get it ready to let: £18,600

Those that are prepared to do work themselves or shop around could reduce this cost.

Dicky Davies, Founder and Business Development Director at Tower Street Finance added: “A home is typically the most valuable asset we own in our lifetime, and so being left one in a Will is of course a great privilege. That said, it certainly doesn’t come without its challenges and costs.

Typically, properties are left to children or grandchildren, and according to HMRC reports, homes make up over half (54%) of the average estate value total at death.

Around a third of estates (that include a property) break the inheritance tax threshold – meaning that many will face another bill to cover this, on top of things like solicitors’ fees, clearing costs and insurance.

Around a third are unaware of what the process is for receiving their inheritance though, how long it could take for them to get full ownership, and a further quarter are unaware if they could also be liable for inheritance tax.

Solicitors can help walk you through the process, and of course we’re also here to help if you want to explore some financial solutions that can help take some of the stress out of the Probate process.”

Please contact us via phone or email if you have questions about any of our Probate Lending solutions.