The Inheritance Index

We’ve explored attitudes to leaving and receiving an inheritance, as well as how much people understand about IHT, Wills and the Probate process.

There is no denying that the topic of inheritance is a tricky one. Not only can it be very emotional – because in order to inherit money a loved one will have passed away – but it is also very complicated and there are lots of rules and processes that aren’t easy to understand.

Two years ago, we ran a survey with 2,000 UK adults who expected to receive some money (at some point) as a Beneficiary of a Will, to find out how much they thought they’d get, from whom they’d receive it and also what their own inheritance plans were. We also asked them about if they’d written a Will, if they could afford funeral costs, and how much they understood about the Probate process.

This October we re-ran that research (with a few extra questions) to see how things have changed, and there are some really interesting takeaways.

As always, our primary goals are to help solve inheritance problems and help you to get some of your inheritance quicker, so if any of the insight from our report sparks some questions, then please contact us via phone or email and we’ll be happy to help.

A Quick Glossary

Before we get into the details, we thought a topline glossary of terms could be handy, as there is a lot of Inheritance-related jargon out there than can be confusing.

- Probate: Probate is the legal and financial process of dealing with the property, money and possessions of a person who has died

- Estate: This is a term used to define the money and property owned by the person who has died

- Beneficiary: A Beneficiary of a Will is a person who stands to benefit from the estate of someone who has passed away. Beneficiaries may be named in a Will or may be included but not named (for example: ‘I leave to my grandchildren…’ to allow for unborn grandchildren when the Will is written)

- Executor: The Executor of a Will is named as responsible for dealing with the estate, including distributing inheritance to Beneficiaries

- Personal Representative: If there isn’t a Will in place, the person named to be responsible for dealing with the estate is called the Personal Representative

- IHT: Inheritance Tax, or IHT as it is also known, is the tax that is charged on the value of a deceased person’s Estate. The tax paid is charged at a rate of 40% when the value of the Estate is above the Inheritance Tax threshold

- Inheritance Advance: Inheritance Advance is an innovative product from Tower Street Finance. Sometimes referred to as an Inheritance Loan or a Probate Loan, it enables Beneficiaries to get some of their inheritance earlier

- Executor Loan: Executor Loan is a product from Tower Street Finance which helps executors, or personal representatives, to fund Funeral costs, Inheritance Tax, Administration fees and other expenses.

Our Top 20 Takeaways

If you only have time to read part of our report, then these are the key stats and takeaways from our 2022 survey.

- Most people (72%) plan to leave money or valuables to their loved ones (typically children and a partner / spouse) when they pass away.

- However, over half of Brits (52%) don’t have a Will in place.

- Women are less likely to have a Will than men.

- Fewer people have a Will written than two years ago, and the Northeast of England is the current ‘no Will capital’ of the UK with 63% of residents yet to write one.

- Londoners are the most likely to have a Will in place (55% said ‘yes’).

- Eight in ten (78%) recognise that without a written Will the Probate process can be slower or that their wishes may not be followed.

- Around one in five Wills are ‘DIY’ – that is they weren’t written with help from a professional Will Writer or Solicitor. We’d advise caution with these, and we’ve explained why in the ‘Will Crisis’ section.

- Most people (60%) believe the current cost of living crisis will impact how much money they can leave when they pass away.

- Brits now expect to leave money and valuables worth £221k to loved ones – 23.5% less than just two years ago.

- People expect to inherit money or valuables worth a total of £334k over their lifetime – this is 56% more than two years ago (when people expected to inherit money / valuables worth £214k).

- Three in ten (29%) said that if they inherited money in the next 12 months, they’d use it to cover living costs – this is more than four times as many than in 2020 (7%).

- Interestingly, more (31%) would take a holiday with it – nearly twice as many than in 2020 (18%).

- 17% are relying on receiving an inheritance (at some point) to cover living costs or pay off debts.

- 17% of 18-24-year-olds and 15% of 24-35-year-olds are banking on receiving an inheritance to get on the property ladder (for their first home deposit).

- On average, Brits believe it takes around 8 months to receive items / money they’ve inherited – however, we’d advise that it actually takes between 9-12 months.

- A third (34%) don’t know what the process is for receiving an inheritance.

- 23% admitted they didn’t know who is responsible for paying in inheritance tax.

- Just four in ten (41%) would have enough money to hand to pay for a funeral for a loved one if needed (based on the average 2022 cost of £4,927) – this is quite a lot less than in 2020 though, when 61% said they could pay for it (the average cost then was £4,400).

- A third (33%) wouldn’t be able to cover the cost of this.

- Of those who couldn’t afford to pay for funeral costs, a third (35%) have no idea how or where they’d find the money.

The Wills Crisis

While it may sound dramatic to call it a ‘crisis’, the reality is that Wills are important legal documents which can greatly affect an inheritance, so it’s a bit worrying how few people have these written up right now.

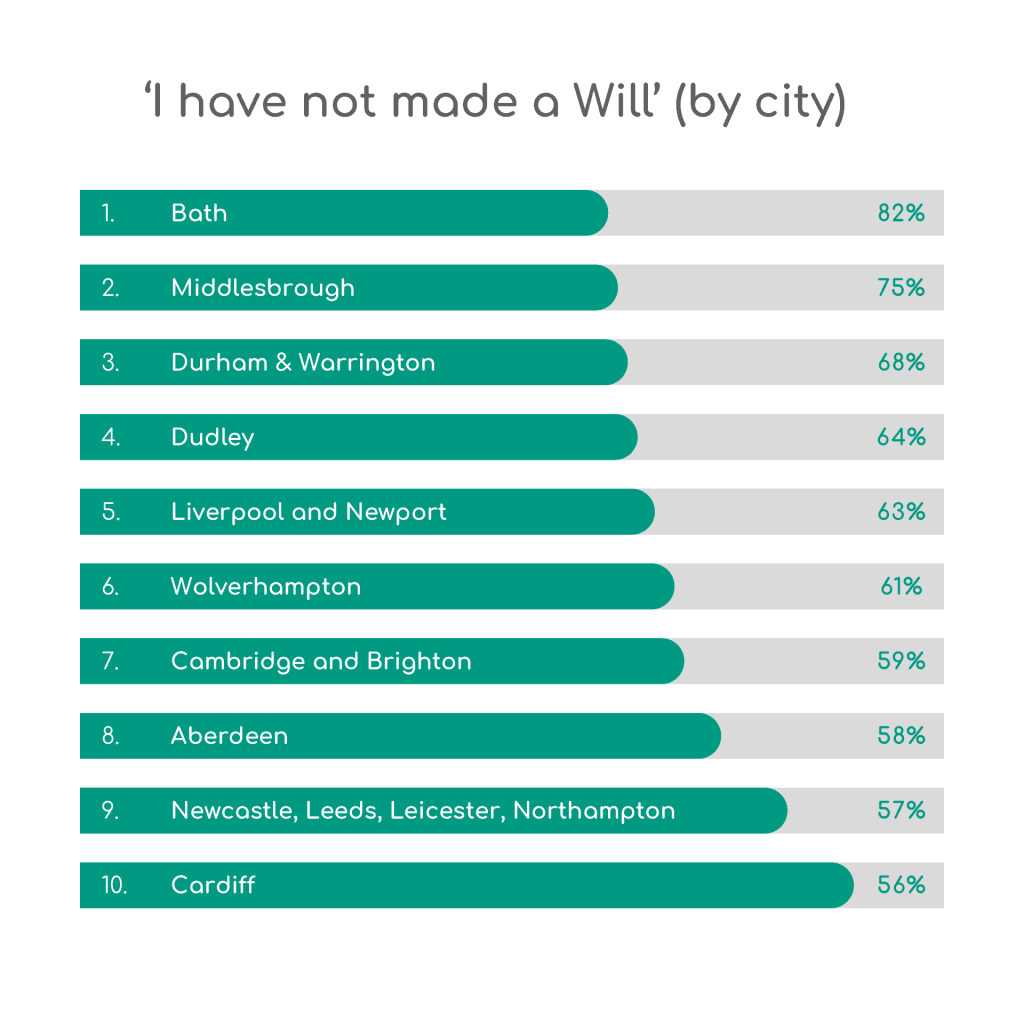

According to our latest survey over half of UK adults haven’t made a Will (52%) – in 2020, this was 45%. Women are also more likely to not have written a Will than men (56% versus 49%).

As may be expected, as we get older, we’re more likely to have a Will. For example, 69% of 18-24-year-olds don’t have one, however only 24% of over 65s said they did not have a Will in place.

‘I have made a Will’ (by region)

- London (55%)

- Scotland and East of England (52%)

- East Midlands (51%)

- Southwest (50%)

- Yorkshire and the Humber (49%)

- Northern Ireland (47%)

- Northern West and Southeast (45%)

- Wales (39%)

- Northeast (37%)

The Northeast was the UK ‘no Will’ capital, with 63% of respondents living there not having one. In contrast, Londoners were the most likely to have a Will in place (55% said ‘yes’).

Despite so few people having a Will ready, seven in 10 (72%) do plan to leave money to loved ones and eight in ten (78%) recognise that if someone passes way without a Will, it can take longer for a beneficiary to receive their inheritance.

Of those who do have a Will, 21% said they’d written it up themselves with no help or guidance from a Will Writer or Solicitors. This is known as a ‘DIY Will’.

Just over one in ten (11%) think there are no risks associated with DIY Wills, while 39% think there may be risks associated with these but aren’t sure what they are.

Around one in eight (16%) believe they’re not legally binding, 17% think there is a chance that a DIY Will could prevent their wishes from being followed and 18% think there is a risk their wishes could be misinterpreted.

Londoners are the most likely to believe there are no risks associated with DIY Wills (18%).

Our Finance Director, Jim Sisson explained why people should be cautious about writing a Will without expert advice. He said:

“A Will is one of the most important documents anyone creates in their lifetime. A properly constructed Will allows certainty of how an individual’s Estate will be dealt with after they have passed away. That said, our latest research suggests less than half of the adult population has one.

Anyone can write a Will, and there are many do-it-yourself solutions available. However, many Solicitors have been advising caution with DIY Wills – which are increasingly popular – as these can lead to disputes and other issues down the line.

Ultimately, a Will is a legal document, and whilst a Court can “look through” a draft and try to ascertain an individual’s intentions, it can be tricky to follow through on wishes if any of the wording is a bit vague or there are any contradictions. A properly drafted Will can avoid these difficulties though, so – unless a person’s affairs are very simple – we recommend seeking professional advice regarding Wills and Estate Planning.

Inheritance Intentions and the Cost-of-Living Crisis

As we’ve already said, according to our research most people (72%) expect to leave an inheritance to family/friend/other people when they pass away. This is fewer people than two years ago though, when 84% said they expect to do this.

The majority (64%) said they plan to leave money or valuables to their children (64%) and half of people (49%) also plan to leave money or valuables to their partner or spouse.

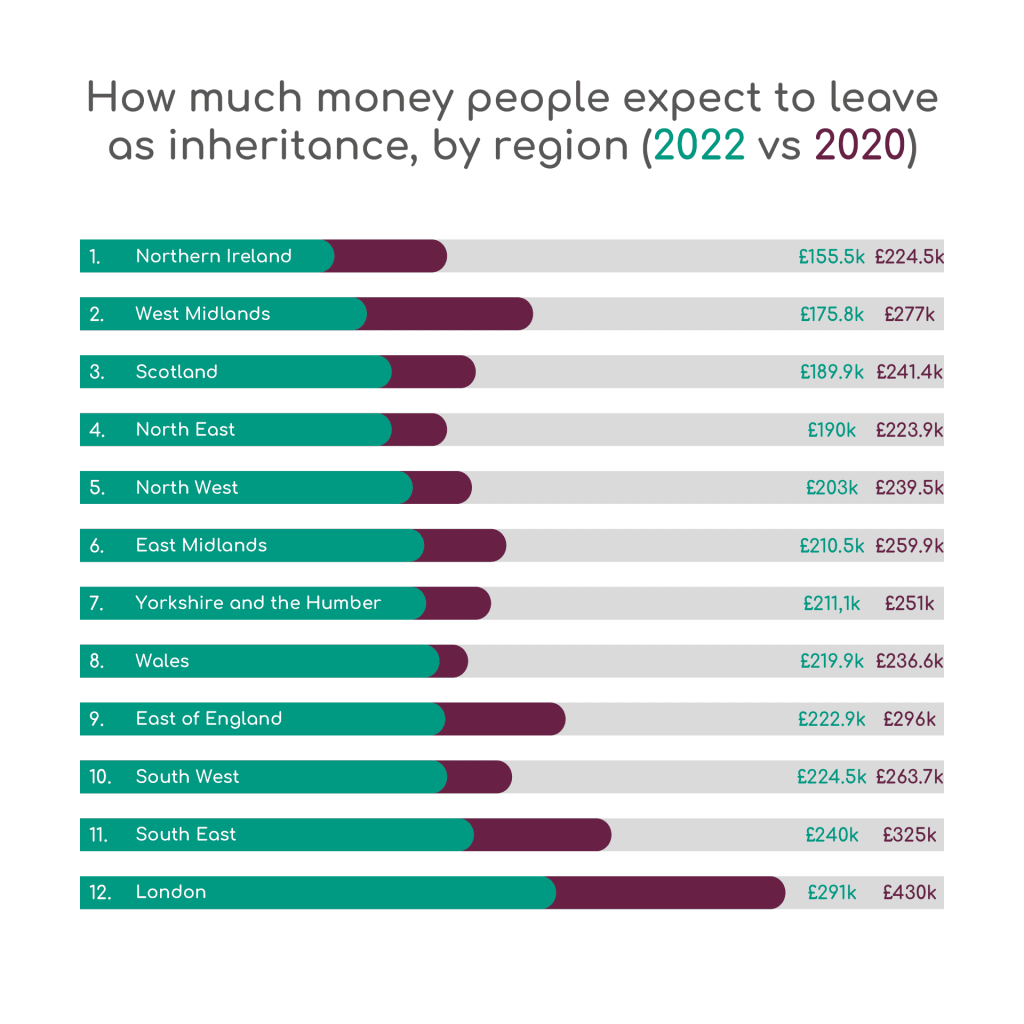

In Autumn 2020 when we last ran our survey, the average total amount that people expected to leave as an inheritance was £289k. In 2022, this has dropped almost 24% to £221k.

Shockingly, one in ten (10%) revealed they had expected leave money to loved ones but no longer believe they will be able leave anything due to rising living costs.

The majority (60%) said they believe the current cost of living crisis will affect how much money they can leave when they pass away and those living in the London (67%) and the West Midlands (66%) are the most likely to feel this way.

Londoners still expect to leave the highest value inheritance (£291k) though, while those in Northern Ireland expect to leave the smallest value inheritance (£155.5k).

Banking on Inheritance

We also asked how much people expect to inherit over their lifetime, and the 2022 total came out at a whopping £334k, which was 56% more than two years ago (when it was £214k)

Four in ten (39%) said they expect to receive an inheritance from their parents, one in five (21%) expect to be left money by their partner, and around one in ten (9%) expect to receive something from their grandparents.

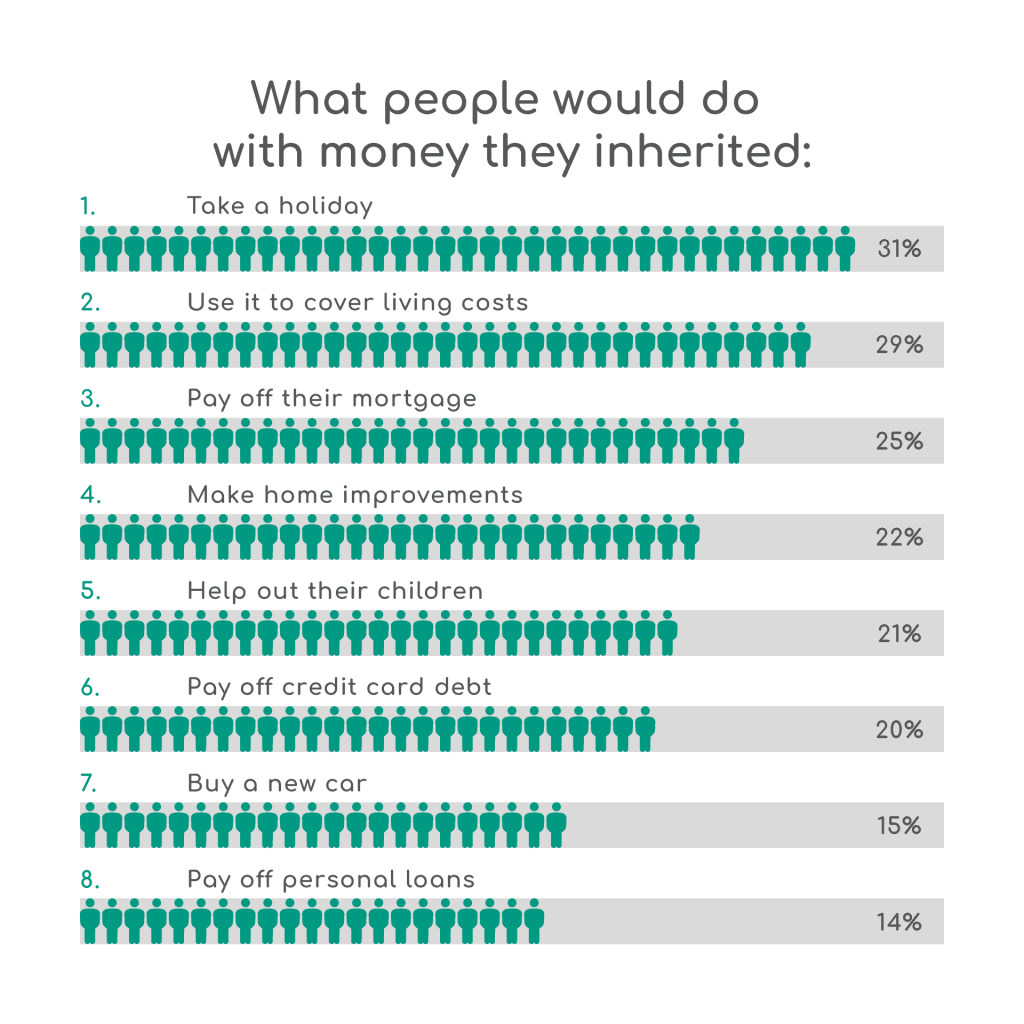

Three in ten (29%) said that if they inherited money in the next 12 months, they’d use it to cover living costs – this is more than four times as many than in 2020 (7%)

Interestingly, more people (31%) would take a holiday with it – nearly twice as many than in our 2020 survey (18%).

A couple of stats we found quite worrying – but perhaps not surprising in the current climate – were that 8% are relying on receiving an inheritance (at some point) to cover living costs, and 9% of Brits are relying on receiving an inheritance (at some point) to pay off debts.

Around one in eight (17%) 18-24-year-olds and 15% of 24-35s are relying on receiving an inheritance to get on the property ladder (first home deposit) too. One in ten (10%) 18-24s are relying on inheriting money to cover University costs as well.

If left a property in a family member’s Will (in the next 12 months), 39% said they’d sell it, while 34% said they’d keep it. In the 2020 survey, 45% said they would sell it and 18% said they’d keep it, so beneficiaries seem more interested in disposing of assets than keeping them.

IHT Rules and the Probate Process – How Savvy Are You?

We are only too aware that there are lots of rules around inheritance tax and that it’s a complex and confusing topic.

How long it takes to receive inheritance…

One thing we feel it’s important people are aware of is just how long it can take to receive money they’ve inherited.

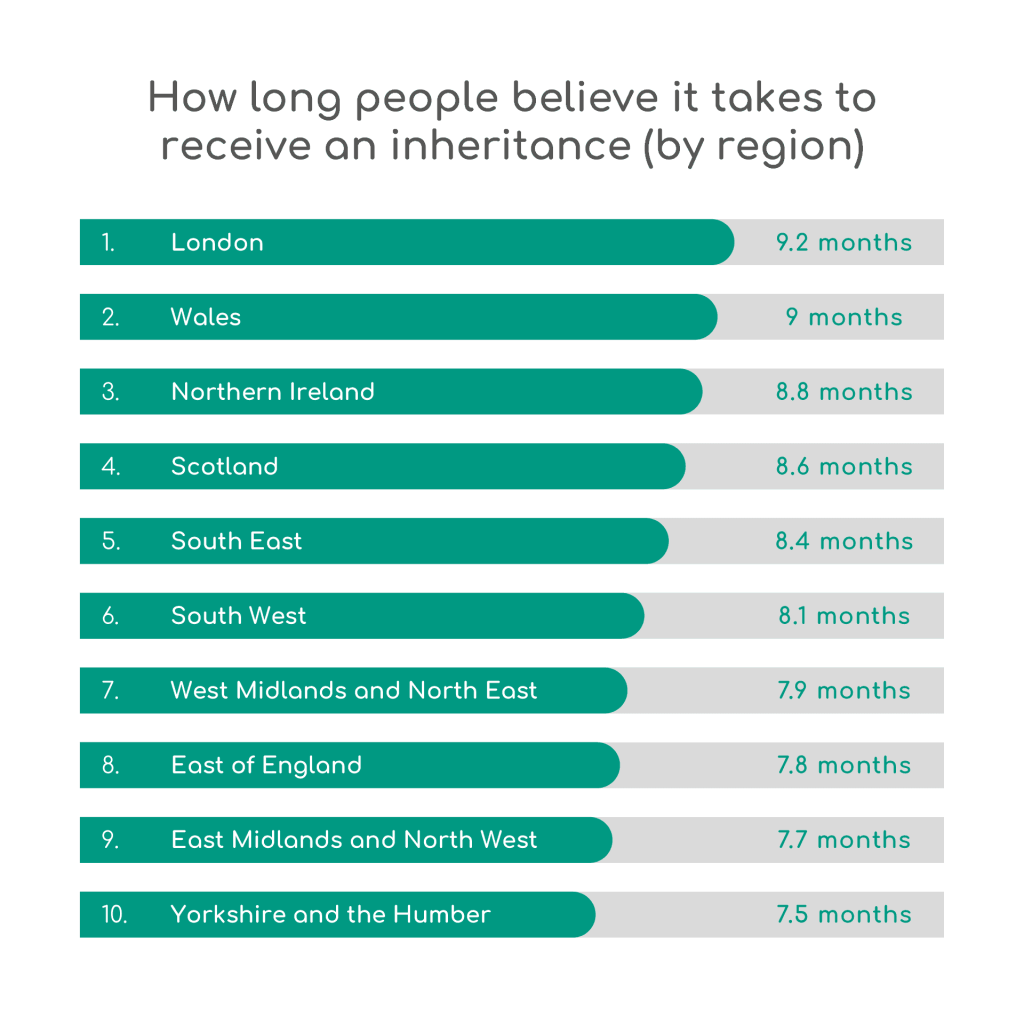

On average, Brits believe it takes around 8 months to receive items / money they’ve inherited. Over a third (36%) believe it takes less than six months though.

In reality, most people are facing a wait of 9-12 months, although solutions such as product (which is a no-risk Probate Loan) can help you access some of your inheritance quicker.

The process for receiving inheritance…

A third (34%) told us they also don’t know what the process is for receiving an inheritance, and women are more likely to admit they don’t know the process than men (37% versus 29%).

We’ve put together a guide on the Probate Process which walks you through every step – it’s worth giving this a read so you’re aware of what order things happen, who is responsible for what and how long things could take.

Paying inheritance tax…

Around a quarter of people (23%) also admitted they didn’t know who is responsible for paying inheritance tax.

- A quarter of people (25%) think that ‘the estate’ is responsible for paying inheritance tax

- A further quarter (25%) think that it is ‘the beneficiaries’

- Just shy of one in ten (9%) think it is ‘the executor of the Will’ who is responsible for paying this

- 6% thought it was ‘the Solicitor’ who paid this

Our Head of Underwriting, Heather Pollard, has explained what inheritance tax is in simple terms. She said: “Inheritance Tax, or IHT as it is also known, is the tax that is charged on the value of an Estate that was owned by someone who has passed away.

The term Estate refers to all their property and valuables. This includes bank accounts, pensions, homes or other buildings / land, jewellery, vehicles, shares, jointly owned assets, and pay-outs from insurance policies.

Any debts, such as mortgages, funeral expenses, other taxes or expenses are taken from the total Estate value first, and then Inheritance Tax is only paid on the remaining amount – if it exceeds the Inheritance Tax threshold.

At this time, the single person’s Inheritance Tax threshold is currently £325,000. So, tax is paid if the value of an Estate is over this amount.

The current tax rate is 40%. That means that if you inherit an Estate with a value of £326,000, you’d only pay 40% tax on the £1,000 that was over the threshold. So, you’d pay £400 in Inheritance Tax.”

She also clarified a few rules you should be aware of depending on if you’re married or cohabiting: “Married or registered civil partners do not have to pay any Inheritance Tax on any asset (money or valuable) left by their spouse.

When the second partner passed away, the Estate then qualifies for something called a married couple’s ‘transferable allowance’. This is essentially the Inheritance Tax threshold times two (for two people) and it currently stands at £650,000 – but only if none of the threshold has been previously used.

The person who then inherits this Estate is would only pay tax on anything over the value of £650,000. This extra transferable element is known in the business as Transferable Nil Rate Band (TNRB).

At this time (October 2022), there is no specific Inheritance Tax allowance or exemption for cohabiting couples though. If you’re not married, but own assets jointly, the situation can get complicated, especially where property is concerned.

If you are joint tenants – meaning you both own all the property – and your partner left you everything in their Will, you would have to pay a 40% tax bill if their assets (including the property you jointly own) are valued at more than the single person Inheritance Tax threshold of £325,000.

After your partner has passed away, the property would be owned by you in its entirety.

If there was no Will, the property can still be transferred to you through the ‘right of survivorship’ and the same Inheritance Tax rules would apply. However, without a Will, any family members of your partner would have a right to claim their share of other assets left, but they’d also then pay their share of any potential tax bill.”

Inheritance tax and gifts….

Did you know that while someone is still alive, they can gift as much money of items of value as they want, to anyone they want, in the form of ‘potentially exempt transfers’ (PETs)?

However, if that person passes away, those gifts (or PETs) can then be included in the total value of their Estate and therefore Inheritance Tax may end up having to be paid.

Under the current rules, if the gift is given before death, and the donor (the person who gave the gift) lives for more than seven years after this, then no Inheritance Tax needs to be paid.

However, if the donor dies sooner, then tax will be charged on the gifts at various levels – but only if the Inheritance Tax threshold is reached.

Gifts use up the Inheritance Tax threshold before other assets such as property and share values are calculated, and they are based on what they were worth at the time of donation.

It’s worth being aware that there are several types of gifts that are exempt from IHT. These are:

- Gifts to your spouse or civil partner

- Gifts to charities

- Multiple gifts up to £250 a year to any other person

- Payments to help an elderly relative or minor with living costs

- Gifts worth £3,000 or less in any tax year (excluding any £250 gifts, provided they are not to the same person)

- Gifts made seven years or more before the donor (gift giver) passed away

- Gifts made out of income once living costs have been paid

Also, when a couple marry some family members are also allowed to give the following wedding gifts and these are exempt from potential Inheritance Tax at any point in time:

- Parents can gift cash up to £5,000

- Grandparents can gift up to £2,500 each

There is a lot more information about Inheritance Tax in this IHT guide.

Funeral Costs

When someone passes away there is typically a funeral to arrange and costs to cover (unless the person who has died sorted these in advance).

We wanted to know how many would be able to cover the typical funeral ‘bill’ and how this compared to a couple of years ago.

In our latest survey we discovered that just four in ten (41%) would have enough money to hand to pay for a funeral for a loved one if needed (based on the average 2022 cost of £4,927) – this is quite a lot less than in 2020, when 61% said they could pay for it (the average cost then was £4,400).

One in five (21%) said they would be able to cover some of the cost, while a third (33%) wouldn’t be able to cover any of the cost of this.

Those living in the Northeast are least likely to be able to pay for this (50%) while those in London are the most likely to be able to pay for some or all of it (67%).

Of those who couldn’t afford to pay for funeral costs, a third (35%) told us that they have no idea how or where they’d find the money, while 15% would borrow from family and 14% would take out a loan.

Some people (7%) said they’d use their inheritance to pay for this, but as we’ve already discussed it can typically take 9-12 months to receive an inheritance so these would need covering a long time before the money came through. Again, this is where some of our funding solutions can help.

Conclusion

It’s clear there is a lot of work to be done in helping the nation to understand and manage Estate Planning and the Probate process.

We’ll continue to share information that we believe may be useful.

We’re also here to help you solve inheritance problems and support you in getting some of your inheritance quicker.

Please contact us via phone or email if you have questions about any of our Probate Lending solutions.

About Our Report Sources and Methodology

- A survey was run with 2,000 UK adults (who are – or expect to be – a beneficiary of a Will) in November 2020, by OnePoll.

- Data was split by respondent age, gender, region and nearest city.

- The same questions were re-run as a survey (to matching audience) in October 2022, with 3Gem.